Ruling Makes alliantgroup the only 179D provider with U.S. Tax Court Validated Process and Methodology

The U.S. Tax Court issued a precedent-setting opinion on IRC sec. 179D for alliantgroup’s client.

Ruling Makes alliantgroup the only 179D provider with U.S. Tax Court Validated Process and Methodology

The U.S. Tax Court issued a precedent-setting opinion on IRC sec. 179D for alliantgroup’s client.

Discover The Benefits Of The 179D Deduction

- The 179D deduction, also called the Energy Efficient Commercial Buildings Deduction, aims to incentivize businesses implementing energy-efficient technologies and practices within commercial buildings.

- Businesses working on buildings owned by government entities, non-profits, Indian tribal governments, or Alaska Native organizations can qualify.

- Eligibility for more than $5.00 per square foot in deductions is possible if the business contributed to the design of HVAC, interior lighting, or the building envelope.

NEED HELP WITH THE 179D DEDUCTION?

Schedule a free consultation

Fill out the form to receive more information

SL | 179D | Commercial Buildings

This form is created for R&D tax credit landing page.

Discover The Benefits Of The 179D Deduction

- The 179D deduction, also called the Energy Efficient Commercial Buildings Deduction, aims to incentivize businesses implementing energy-efficient technologies and practices within commercial buildings.

- Businesses working on buildings owned by government entities, non-profits, Indian tribal governments, or Alaska Native organizations can qualify.

- Eligibility for more than $5.00 per square foot in deductions is possible if the business contributed to the design of HVAC, interior lighting, or the building envelope.

NEED HELP WITH THE 179D DEDUCTION?

Schedule a free consultation

Fill out the form to receive more information

SL | 179D | Commercial Buildings

This form is created for R&D tax credit landing page.

Total Deduction:

$10 Million

Project Types Include: K-12 Schools, City Housing, Higher Education, Libraries, Police Stations

Total Deduction:

$6 Million

Project Types Include: Nursing Schools, Higher Education, K-12 Schools, Hospitals, College Dormitories

Total Deduction:

$2.8 Million

Project Types Include: Fire Stations, Police Stations, K-12 Schools

Who Can Claim 179D?

Architects, engineers, and design-build contractors that work on new or renovated government-owned buildings and structures, for example:

K-12 Schools

MILITARY BASES

Prisons

Non - Profits

Hospitals

COURTHOUSES

UNIVERSITIES

LIBRARIES

AIRPORT

CITY PARKS

Tribal Lands

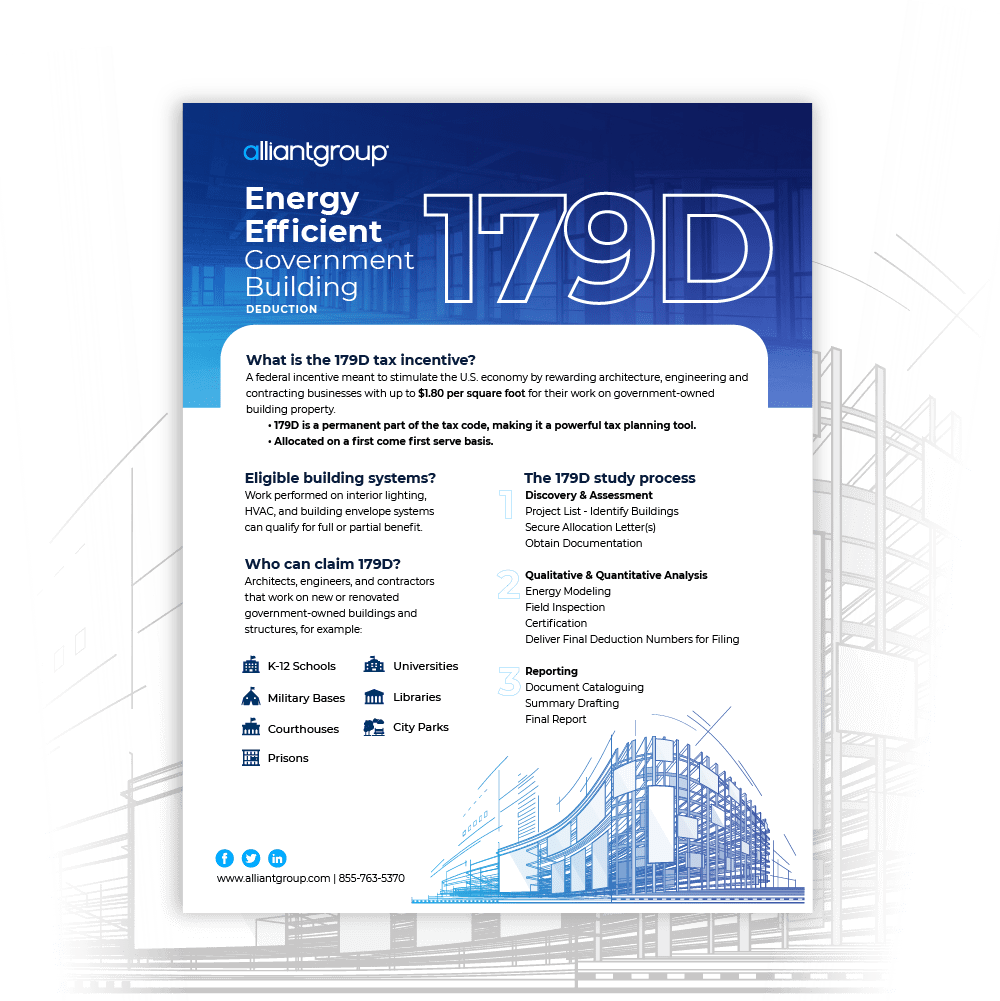

The 179D Study Process

To qualify for the 179D tax deduction, one needs to follow due process. Broadly there are two parts to the 179D study process.

- Evaluation: In this part, you evaluate the building to determine if they qualify for 179D tax deduction. The building is also compared to the reference model for energy efficient qualifications under ASHRAE norms. This also involves a physical visit to the building by a licensed qualified third party in the state.

- Documentation: There are two primary documents required for 179D tax deduction. Allocation letters confirming ownership of property, energy efficiency of the building and signed by authorized personnel are required for 179D tax deduction. Secondly, a report certifying the building qualifies for 179D along with an energy model that shows energy reduction compared to ASHRAE standards.

1. Discovery & Assessment

Project List – Identify Buildings Secure Allocation Letter(s) Obtain Documentation

2. Qualitative & Quantitative Analysis

Energy Modeling, Field Inspection, Certification, and Deliver Final Deduction Numbers for Filing

3. Reporting

Document Cataloguing, Summary Drafting, and Final Report

How Can We Help? The alliantgroup Advantage

We are the leading experts in tax credits and incentives. Since 2002, we have helped US businesses grow their operations and stay ahead of the competition. To date, we have delivered billions in refunds to over 27,000 businesses.

- Risk-free, no-cost preliminary assessment

- Top-class staff of licensed engineers in every state who give utmost attention to every aspect of the whole process

- State-of-the-art cutting-edge proprietary software interface that aligns with the US Department energy modeling software used by the IRS

- Best licensed engineers in all 50 states

- A highly skilled team of energy modelers who specialize in the three qualifying building systems

- Well-established relationships with 8000+ government entities

alliantgroup has delivered over $3 billion in 179D tax deduction. Our track record is as follows:

- Nearly $13.3M deduction identified for 51 properties in architecture and engineering

- Close to $12.8M deduction for a design-build contractor in controls, HVAC, and sheet fabrication

- Total $2.6M deductions for design-build contractors in interior lighting and HVAC

WHITEPAPER DOWNLOAD

A Guide on How You Can Claim the 179D Deduction

The Consolidated Appropriations Act of 2021 made the Section 179D Energy Efficient Building Deduction permanent and gives business owners and government contractors a tax incentive for energy-efficient improvements to commercial and government buildings.

GC | 179D | Insights 179D - Energy Efficient Government Building Deduction | New

GC | 179D | Insights 179D - Energy Efficient Government Building Deduction | New

What Improvements are Eligible for this Tax Deduction?

Taxpayers who invest in constructing new buildings or improving their existing buildings are eligible for 179D deduction. These investments must be aimed at reducing energy use. The improvements eligible under ASHRAE standards include:

- Building envelope improvements

- HVAC improvements

- Interior lighting solutions

Maximize Your 179D Deduction: Check If You Qualify

We'll help you determine your eligibility, ensure everything is properly allocated, and maximize your deduction for no upfront fees. Complete the form below to estimate your refund.

Testimonials

Hear From Our Clients

What are the Benefits of the 179D Tax Deduction?

You can claim up to $5.00 per square feet of the building worked on. For example, if the qualified building is 100,000 square feet, that could mean up to a $500,000 tax deduction for the work completed.

What is the 179D Tax Deduction?

Section 179D is a deduction that allows building owners to claim up to a $5.00 per square feet for energy-efficient buildings or installing systems to that effect. To qualify, newly constructed or renovated buildings must meet or exceed some key energy reduction requirements and ASHRAE standards. Section 179D is meant to stimulate the economy by rewarding architecture, engineering, and design-build contractor businesses for their work on government-owned buildings.

NEED HELP WITH THE 179D DEDUCTION?

Fill out the form to receive more information

SL | 179D | Commercial Buildings

This form is created for R&D tax credit landing page.

WHITEPAPER DOWNLOAD

A Guide on How You Can Claim the 179D Deduction

The Consolidated Appropriations Act of 2021 made the Section 179D Energy Efficient Building Deduction permanent and gives business owners and government contractors a tax incentive for energy-efficient improvements to commercial and government buildings.

GC | 179D | Insights 179D - Energy Efficient Government Building Deduction | New

FAQ’s – Frequently Asked Questions

Now buildings owned by non-profits and tribal lands qualify for the 179D Deduction. The Inflation Reduction Act has expanded eligibility for more entities.

The tax deduction is available for 3 years from the time of filing an original return.

It depends – the deduction is based on square footage and documentation showing the activities performed on each project. Talk to an expert as soon as possible if you are unsure if your work on a project is eligible.

Ready to

get started?

alliantgroup can help determine if your construction project will qualify for the 179D deduction as well as other tax credits and incentives.

Words From Our Clients

I was impressed by the time taken to educate me about how the 179D tax deduction could directly impact our business based on our work with energy-efficient projects.

John Watson

Smith Engineering

Total Deductions:

$10 Million

Project Types Include: K-12 Schools, City Housing, Higher Education, Libraries, Police Stations

Design & Product Engineering Consulting Firm

ANNUAL REVENUE:

$33 Million

TOTAL CREDITS EARNED:

$670,000

Products & Manufacturing Processes Developer

ANNUAL REVENUE:

$13.5 Million

TOTAL CREDITS EARNED:

$310,000

Who can

Claim 179D

Architects, engineers, and contractors who work on design or installation aspects of new or renovated government-owned buildings and structures.

Owners and tenants of commercial buildings who have built or installed the improvements.

Owners of four-story or greater residential buildings who have built or installed the improvements.

K-12 Schools

MILITARY BASES

Prisons

COURTHOUSES

UNIVERSITIES

LIBRARIES

AIRPORT

CITY PARKS

How

179D Tax Deduction Works

Building owners or government contractors can take the opportunity to claim a federal tax deduction of up to $1.80 per square foot of a building’s floor area if they install property that reduces energy and power costs. These installations or design efforts need to be a part of the building’s interior lighting systems; heating, cooling, ventilation, hot water systems or building envelope. The deduction is allowed for both new construction and remodeling buildings.

To qualify, the energy and power costs of a building must be reduced by at least 50% or more in comparison to the minimum requirements of “ASHRAE” (American Society of Heating, Refrigeration, & Air-Conditioning Engineers) standard. If the 50% target saving is not met, the provision allows partial deduction of $0.60 per square foot for each of the following components:

- Building envelopes

- Heating, Ventilation, and Air Conditioning (HVAC).

- Interior lighting systems

Who can

Claim 179D

Architects, engineers, and contractors that work on new or renovated government-owned buildings and structures.

Owners and tenants of commercial buildings who have built or installed the improvements.

Owners of four-story or greater residential buildings who have built or installed the improvements.

K-12 Schools

MILITARY BASES

Prisons

COURTHOUSES

UNIVERSITIES

LIBRARIES

AIRPORT

CITY PARKS

Calculate Your 179D Deduction

Take our short quiz to estimate the amount of deduction your company may be entitled to

Our Process

The 179D Study Process

With alliantgroup, there is an easy 3-step study process:

1.

Discovery

Assessment

Project List – Identify Buildings, Secure Allocation Letter(s), Obtain Documentation

2.

Qualitative &

Quantitative Analysis

Energy Modeling, Field Inspection, Certification, and Deliver Final Deduction Numbers for Filing

3.

Effective

Reporting

Document Cataloguing,

Summary Drafting, and

Final Report

Case Studies

- Mechanical contractor renovated cooling towers on subsidized housing – $579,342 in deductions

- Architecture firm renovating and building 18 new public schools – $930,377 in deductions

- Program manager renovating 51 buildings including colleges, prisons and hospitals – $13,391,241 in deductions

Case Studies

Mechanical Contractor Renovated Cooling Towers on Subsidized Housing - $579,342 in Deductions

Architecture Firm Renovating and Building 18 New Public Schools - $930,377 in Deductions

Program Manager Renovating 51 Buildings Including Colleges, Prisons and Hospitals - $13,391,241 in Deductions

alliantgroup advantage

alliantgroup has continued to be the industry leader in 179D tax credits and incentives. Take a look at some of the key aspects that set us apart from our competition.

Risk-free, no-cost preliminary assessment.

Top class staff of licensed engineers in every state who give utmost attention to every aspect of the critical 179D tax deduction.

State of the art cutting edge proprietary software interface that aligns with the US Department energy modeling software used by the IRS.

Highly skilled team of energy modelers who specialize in the three qualifying building systems.

Well established relationships with 8000+ government entities.

Associated with AEC (Architecture, Engineering, Construction) based associations like CFMA, NECA, CICPAC, and ACEC.

FOUND

more than

$3.8 BILLION

IN 179D Tax Deduction

WORKING

WITH OVER

8,000

government entities

certified More

than

20,000

Building

Partnerships

with more than

4000

CPA Firms

Featured in:

What is

179D Tax Deductions

179D is a federal incentive intended to stimulate the U.S. economy by rewarding architecture, engineering, and contracting businesses with up to $1.80 per square foot for their work on government owned building property. Work performed on interior lighting, HVAC, or a building’s envelope system can qualify for full or partial benefit.